Insights, Research and Trends

Vitamin D3 and ageing diseases

A clinical trial showing that vitamin D3 supplementation could help reduce age-related DNA damage won major headlines in the UK national media.

The Times reported that D3 “could help to turn back the clock on biological ageing” following the trial reported in the American Journal of Clinical Nutrition.

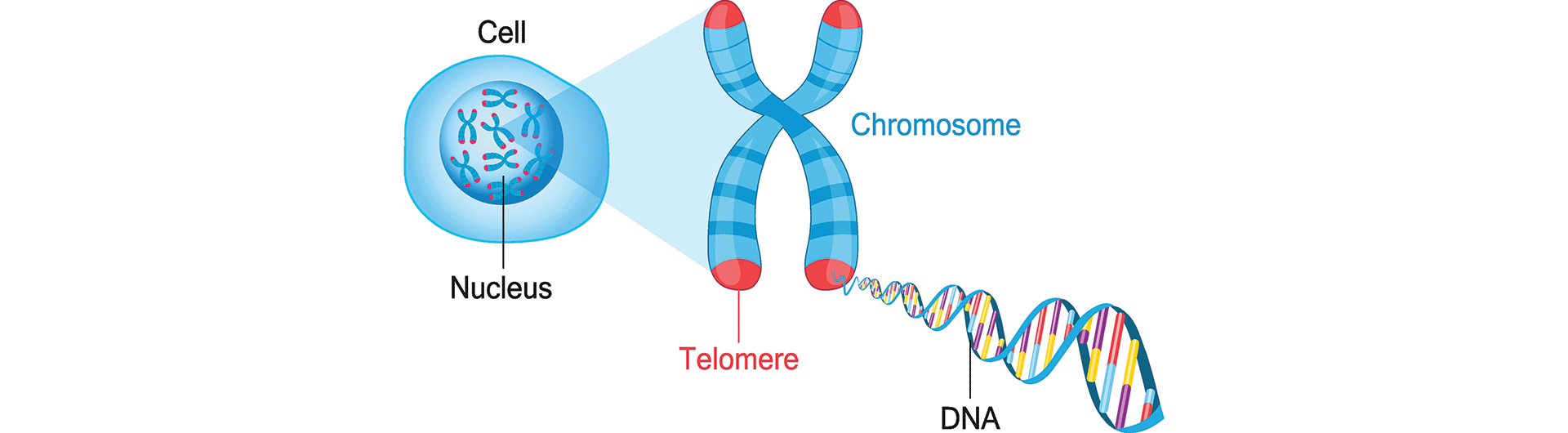

The placebo-controlled study involved more than 1,000 adults aged 50 or over who were given regular blood tests over four years to measure telomeres which protect DNA from damage and naturally shorten with age.

Over time, telomeres get shorter, which means the DNA is no longer protected so cells can no longer properly divide and renew. The process is linked to cancer, heart disease, Alzheimer’s and a weakened immune system.

The study, led by Harvard University’s research centre, involved a daily dose of 2,000 IU of D3 and demonstrated benefits in lowering the risk of certain chronic ageing diseases, including advanced cancer and autoimmune disease.

EFSA confirms probiotic strain

In a significant moment for the probiotics industry, the European Food Safety Authority (EFSA) has given its approval to using Clostridium butyricum as a novel food. The strain produces butyrate, a short-chain fatty acid considered to be beneficial for gut health especially in cases of diarrhoea, constipation and other gastrointestinal issues. Emerging research has also suggested benefits for conditions such as asthma and mental health.

‘Dear internet, what’s wrong with me?’

Is search engine and AI self-diagnosis a good or a bad thing? Health experts find it worrying, but then they would, wouldn’t they?

Thanks to a survey of the questions asked online, the natural health sector’s knowledge base can be brought to bear providing it keeps up to speed with the trends.

The online mental health platform MEDvidi examined how often people are searching for over 3,660 keywords related to hypochondria, self-diagnosis and illness symptoms such as “virus symptoms,” “health anxiety,” and “symptom checker.”

The study revealed which illnesses people are most frequently self-diagnosing over the internet, with flu, ADHD, and depression taking the top spots in the ranking. For each illness, the study calculated a total average monthly search volume, which then determined the final ranking.

Flu takes the top spot in the ranking, with an average monthly search volume of 438,432. The study found that “flu symptoms,” “flu signs,” and “adult flu symptoms” are all popular search terms relating to the illness.

ADHD is in second place, with a search volume of 325,548. Interestingly, the study found that “ADHD symptoms in women” is one of the most popular search terms related to the disorder, despite the fact that more men than women receive a diagnosis for ADHD. “ADHD test” is another recurring search term, demonstrating the high number of individuals attempting to self-diagnose over the internet.

Depression is in third place, amassing a national search volume of 286,666. “Depression test,” “Signs of depression,” and “Depression symptoms” are all recurring search terms related to the illness.

Other high-ranking illnesses that people are frequently attempting to self-diagnose online include gout, prostate cancer, and Covid-19.

Online health obsession boom leads to bust for many

From vitamin supplements to protein shakes, slimming pills, hormone balancing and libido enhancing remedies – a study suggests Brits now shell out over £2,000 a year (£184 a month) on ‘healthy lifestyle’ products, in a bid to make them feel and look better.

In fact, a staggering 93% believe the internet and social media has created a global obsession with wellness, health and beauty products.

Gen Z are most likely to be convinced by what they see online, with three-quarters admitting to buying ‘game-changing’ products.

And interestingly, men fork out more on health and wellness a month, £199 on average, as opposed to the £169 average for women, according to data from Green Chef.

As many as 53% say they have been scammed by dupe products they saw advertised online, while the average respondent said they have only been impressed with the results of around a quarter of the products they have bought online.

Half of the 2,000 Britons surveyed by Green Chef admit they are prioritising supplements over eating a healthy diet. That figure rises to 60% of Gen Z respondents.

Almost a third (30%) admit they don’t pay enough attention to their diet, with many consuming sugars and refined carbohydrates on a daily basis, such as crisps (52%), sweets and chocolates (44%), white bread (44%) and fast food (41%).

Leafy greens, which contain folates that encourage hair growth, were missing from a third of British diets, followed by protein-rich oily fish (32%) which can support muscle repair, immune-supporting roots such as ginger (25%) and high-fibre wholegrains that can aid digestion (23%).

Young people seek to shed the pounds

Young consumers aged 18-34 are showing the highest interest in weight loss drugs such as Wegovy and Mounjaro, according to Mintel research.

Almost half (48%) of the UK’s 18-34s trying to manage their weight have either used prescription weight-loss drugs in the past year or are interested in doing so in the future. This compares to a national average of just 30%.

Almost nine in ten (86%) of Britain’s 18-34s are actively managing their weight compared to an average of 73% of all Brits. While women of all ages are equally as likely to be trying to lose or maintain weight, men aged 18-24 (27%) are nearly three times more likely than any other group to be trying to gain weight.

Overall, almost eight in ten (77%) of 18-34s managing their weight are exercising to do so while 37% are managing their weight by diet. A further 26% are using non-prescription weight-loss products, such as fat burners, metabolisers and weight-loss teas.