ProVeg puts the plant milk case

From the ProVeg report

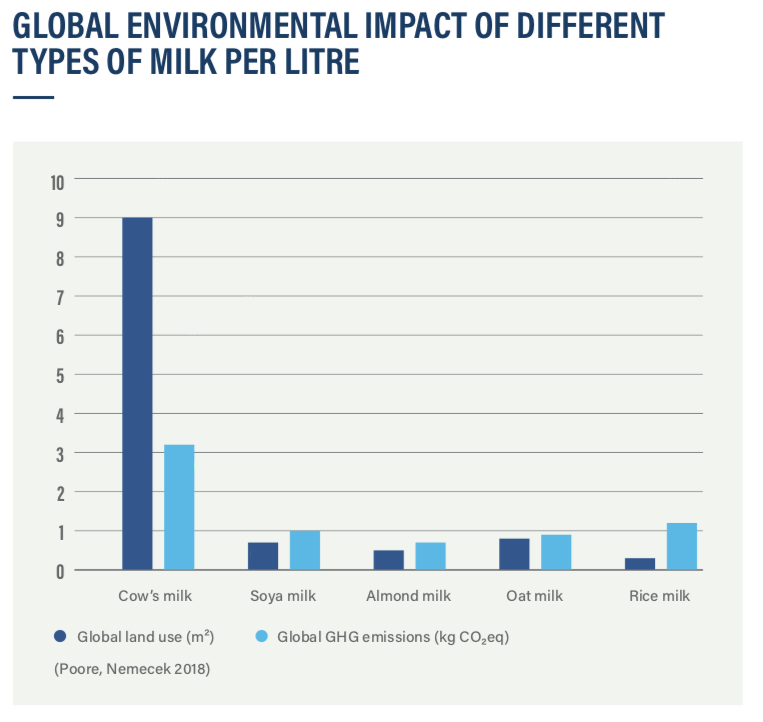

International food awareness organisation ProVeg has produced a 30-page report on the global rise of plant milk, highlighting the reasons for the staggering growth of soya, almond, oat and coconut alternatives.

Of all the plant-based product categories, plant milk has the highest market value and penetration. In the US, in the year leading up to June 2018, sales of plant-based milk rose 9%, while sales of traditional cow’s milk declined 6%, resulting in plant milks accounting for 15% of total milk sales.

In Europe, a similar story is unfolding in markets such as Germany, the UK and the Netherlands. According to Research and Markets, revenue from the global non-dairy milk market is set to reach more than $38 billion by 2024, growing at a compound rate of more than 14% between 2018 and 2024.

Plant milk has become a household staple in several markets and is no longer consumed exclusively by vegans and vegetarians. A study conducted by Cargill revealed that 50% of US consumers now purchase both dairy and dairy alternatives, while 43% of Europeans do the same.

Companies of all sizes are increasingly tapping into the potential of the plant-based milk market, employing a number of different entry strategies to do so. The multinational food corporation Danone acquired the market-leading brand Alpro in 2016 in a bid to increase its presence in the plant-based market.

Startups continue to find new niches thanks to the myriad opportunities presented by the sheer number of raw materials in the plant kingdom, each with their own unique properties. For example, peas, considered by many to be the sector’s rising star, are currently being used in plant-based dairy products. The Mighty Society, Ripple Foods, and Vly Foods (a startup from the ProVeg incubator), have all brought pea-based milk to market, inspired by its impressive nutritional profile.

In the UK market, 91% of shoppers surveyed expressed satisfaction with the consistency of the plant-based milk they buy (of which 66% were very satisfied), 90% with the taste (of which 65% were very satisfied), and 80% with its perceived naturalness (of which 55% were very satisfied). Price invited the least positivity, with 22% neutral and around 10% dissatisfied.

Download the full ProVeg report here.

Read more Insights here...