Why the VMS category is in good health

Source: Euromonitor

Modern lifestyles and growing health awareness are providing a rosy future for VMS sales, according to market research carried out for Solgar®.

Add to that consumer concerns about the side effects of medicines together with demand for ‘natural’ and ‘functional’ products, and the steady growth of the VMS and sports nutrition categories will continue.

Sales of vitamins and supplements are estimated to have reached £442m in 2018, a rise of 6% from £417m in 2013 (source: Mintel). The sector is predicted to see a steady rise in value sales over the next five years, with the market forecast to grow a healthy 8% to reach £477m in 2023.

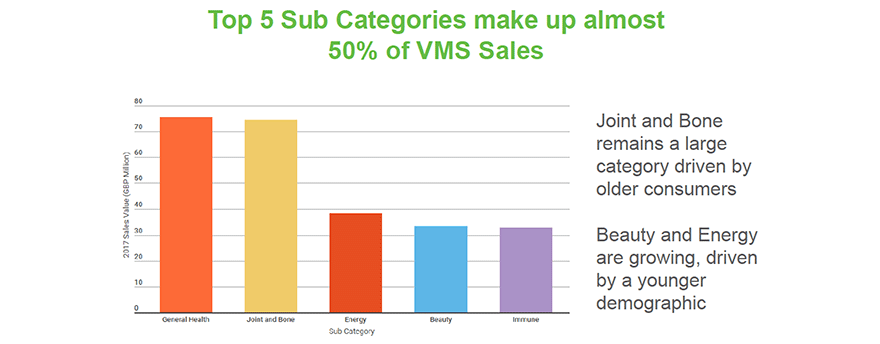

Joint and bone health remains a large sub-category (approx. £75m by value in 2017, source: Euromonitor) driven by older consumers, but the beauty and energy categories (approx. £39m and £34m respectively) are growing fast, driven by a younger demographic. Digestive and men’s health are also among the fastest growing categories.

Physical shops remain the primary destination for VMS purchases but online is growing – 47% of UK consumers say they buy from a physical store compared with 18% online, while 35% have never bought supplements.

However, more than half of consumers (56%) say they are confused by the VMS category, an indicator of the strong showing among those seeking face-to-face advice at health stores. Millennials are driving category growth, especially in shopping for condition-specific products.

The top five attributes listed by consumers are quality, a trusted brand, scientific research, ease of use and being readily available.

For more information, see your Solgar representative, and visit the Solgar blog.

Read more Insights here...